If you are researching the california lemon law mileage offset calculation, you are likely trying to understand how much money will be deducted from your refund if your vehicle qualifies as a lemon in California.

Under California law, vehicle buybacks are governed by the Song-Beverly Consumer Warranty Act. This law requires manufacturers to repurchase or replace vehicles that cannot be repaired after a reasonable number of attempts.

However, California allows manufacturers to deduct a mileage offset (also called a usage fee). This deduction often causes confusion.

This guide explains:

- What the mileage offset is

- The california lemon law buyback formula

- How lemon law mileage is calculated

- How to estimate your refund using a lemon law buyback calculator

- Whether you need a lawyer

This is general legal information for California consumers, not legal advice.

What Is Lemon Law California?

When people ask “what is lemon law california,” they are usually referring to protections under the Song-Beverly Act.

In practical terms, the law applies when:

- The vehicle is still under the manufacturer’s warranty

- The manufacturer (or dealer) cannot fix a substantial defect

- The problem affects use, value, or safety

- A reasonable number of repair attempts have occurred

If those conditions are met, the manufacturer must:

- Repurchase (buy back) the vehicle, or

- Provide a replacement vehicle

But a repurchase is not always a full refund of every dollar paid. That is where the california lemon law mileage offset calculation comes into play.

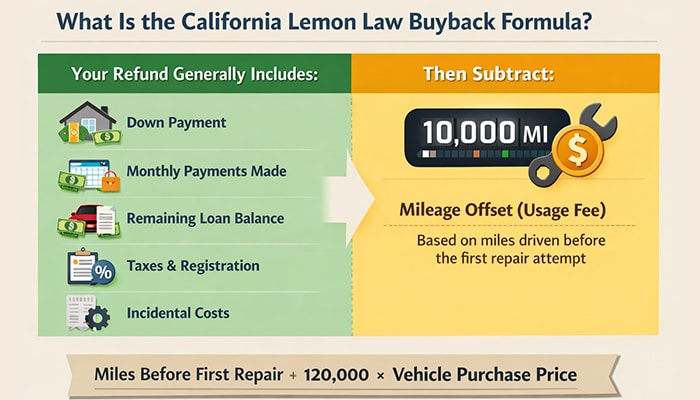

What Is the California Lemon Law Buyback Formula?

The california lemon law buyback formula determines how much the manufacturer must refund.

Generally, the refund includes:

- Down payment

- Monthly payments made

- Remaining loan balance (paid to lender)

- Taxes and registration

- Certain incidental costs

Then, the manufacturer subtracts:

- A mileage offset (usage fee)

The usage fee is calculated based on how many miles were driven before the first repair attempt for the defect.

How the California Lemon Law Mileage Offset Calculation Works

The california lemon law mileage offset calculation uses a statutory formula:

(Miles driven before first repair attempt ÷ 120,000) × Vehicle purchase price

Breaking it down:

- Identify the mileage at the first repair attempt for the defect.

- Subtract mileage at delivery (if necessary).

- Divide that number by 120,000.

- Multiply by the vehicle’s purchase price.

Example Calculation

- Purchase price: $40,000

- Miles at first repair attempt: 10,000

Step 1:

10,000 ÷ 120,000 = 0.0833

Step 2:

0.0833 × $40,000 = $3,333

The manufacturer may deduct $3,333 as lemon law mileage usage.

This deduction reflects the portion of the vehicle’s expected 120,000-mile life that was used before the defect was first reported.

Important Clarification About Lemon Law Mileage

Many consumers misunderstand how lemon law mileage works.

Common Misunderstandings

Myth: The offset is based on total miles at buyback

Fact: It is based only on miles at the first repair attempt

Myth: The deduction includes all miles driven

Fact: Only pre-repair-attempt miles are included

Myth: You lose all money paid

Fact: You are refunded most payments minus the usage fee

This distinction can significantly change your refund amount.

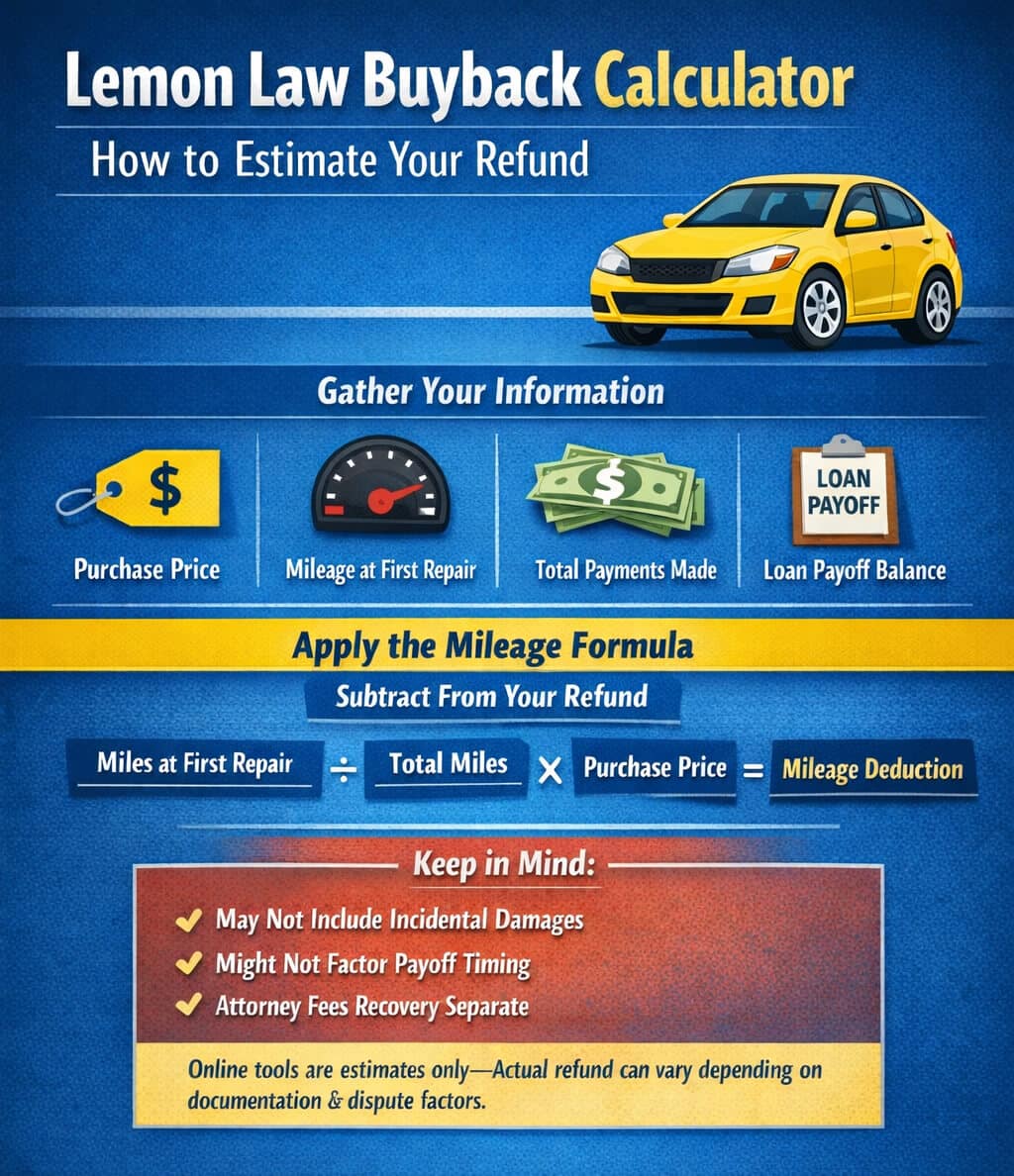

Lemon Law Buyback Calculator: How to Estimate Your Refund

Many websites offer a lemon law buyback calculator or lemon law calculator. These tools estimate your refund using the statutory formula.

To estimate manually, gather:

- Purchase price

- Mileage at first repair attempt

- Total payments made

- Loan payoff balance

Then apply the mileage formula and subtract it from your total refund.

Keep in mind:

- Some calculators do not include incidental damages

- Some do not factor in payoff timing

- Attorney fee recovery (if applicable) is separate

Online tools are estimates only — the actual refund can vary depending on documentation and dispute factors.

Real-World Factors That Affect the Buyback Amount

The california lemon law buyback formula is straightforward, but disputes can arise over:

- When the first qualifying repair occurred

- Whether the defect was properly documented

- Whether the vehicle qualifies as a lemon at all

- Optional add-ons included in purchase price

Manufacturers sometimes challenge mileage documentation or argue that earlier visits were not for the same defect.

Key Differences Between Manufacturer Arbitration and a Lemon Law Lawsuit

| Factor | Manufacturer Arbitration | Lemon Law Lawsuit |

| Who Decides the Case | Neutral arbitrator (often through a manufacturer-sponsored or third-party program) | Judge or jury in civil court |

| Formality | Informal process | Formal litigation procedure |

| Speed | Typically faster (weeks to a few months) | May take several months to over a year |

| Cost to Consumer | Usually free | Attorney’s fees recoverable if you prevail under the Song-Beverly Consumer Warranty Act |

| Evidence Rules | Relaxed | Strict evidentiary and procedural rules |

| Discovery (Document Exchange) | Limited | Full discovery rights (documents, depositions, subpoenas) |

| Ability to Appeal | Limited or none | Appeal rights available |

| Binding Decision | Sometimes binding on manufacturer only (varies by program) | Court judgment is legally binding |

| Settlement Leverage | Lower pressure on manufacturer | Higher leverage due to litigation risk |

| Risk of Low Award | Possible if arbitrator favors manufacturer documentation | Court oversight may reduce under-valuation risk |

| Public Record | Usually private | Public court record |

Do You Need a Lawyer for a Mileage Offset Dispute?

Not every case requires an attorney.

You may be able to handle it yourself if:

- The manufacturer already agrees the vehicle qualifies

- The mileage records are clear

- The buyback amount is straightforward

You should strongly consider legal help if:

- The manufacturer denies lemon status

- There is a dispute over first repair date

- The mileage offset appears inflated

- Settlement offers seem unusually low

Under California law, if you prevail, the manufacturer typically pays reasonable attorney’s fees. That reduces financial risk for many consumers.

When Vehicles Do Not Qualify

Even if you calculate a low mileage deduction, the vehicle must still meet legal standards.

Common reasons claims fail:

- Not enough repair attempts

- The issue is minor

- The vehicle is out of warranty

- The defect does not substantially impair use, value, or safety

The mileage offset only matters after the vehicle qualifies.

Key Takeaways on California Lemon Law Mileage Offset Calculation

- The california lemon law mileage offset calculation is based on miles at the first repair attempt.

- The statutory divisor is 120,000 miles.

- The deduction is usually much smaller than consumers fear.

- Online lemon law buyback calculator tools provide estimates, not final figures.

- Documentation of the first repair visit is critical.

Practical Next Steps

If you believe your vehicle qualifies:

- Gather purchase documents.

- Locate repair invoices.

- Identify the first repair attempt date and mileage.

- Estimate your mileage offset.

- Compare the manufacturer’s offer to your calculation.

If there is a disagreement over qualification or refund amount, speaking with a California lemon law attorney may help clarify your position.

Conclusion: Understanding the California Lemon Law Mileage Offset Calculation

The california lemon law mileage offset calculation is a straightforward statutory formula based only on the miles driven before the first repair attempt. While manufacturers are allowed to deduct this usage fee, it typically represents a limited portion of the total refund. The most important factors are proper documentation, accurate mileage records, and confirming that the vehicle qualifies under the Song-Beverly Consumer Warranty Act. Before accepting any buyback offer, compare the numbers carefully to ensure the deduction is calculated correctly.

Disclaimer:

This article provides general information about California lemon law and mileage offset calculations. It is not legal advice. Laws change, and individual circumstances vary. For advice about your specific situation, consult a qualified California attorney.